A non-technical way to reduce your AWS bill within 5 minutes

Are you looking for ways to reduce your monthly AWS bill? Usually, I do share technical tips and tricks to do so: 3 simple ways of saving up to 90% of EC2 costs or Performance boost and cost savings for DynamoDB. But today, I will share a nontechnical way to reduce your monthly AWS bill by around 15 percent.

Disclaimer: I’m an expert in all things AWS, Serverless and DevOps and not a tax consultant. You should double check and discuss the following facts with your tax consultant.

By default, AWS charges value added taxes (VAT) for all customers based in the European Union. By entering your VAT registration number, you can stop AWS from adding VAT to your monthly bill. That’s reducing the invoice amount by 16 percent for a German business, for example.

You may have to self-account for VAT on your local VAT return. But usually, a business can make use of input tax deduction which means you don’t have to pay VAT on your AWS usage.

How to enter your VAT registration number? You have to go through the following process within all your AWS accounts. Even if you use consolidated billing with a single master account, you still need to enter your VAT registration number in all the member accounts.

- Log into the AWS Management Console.

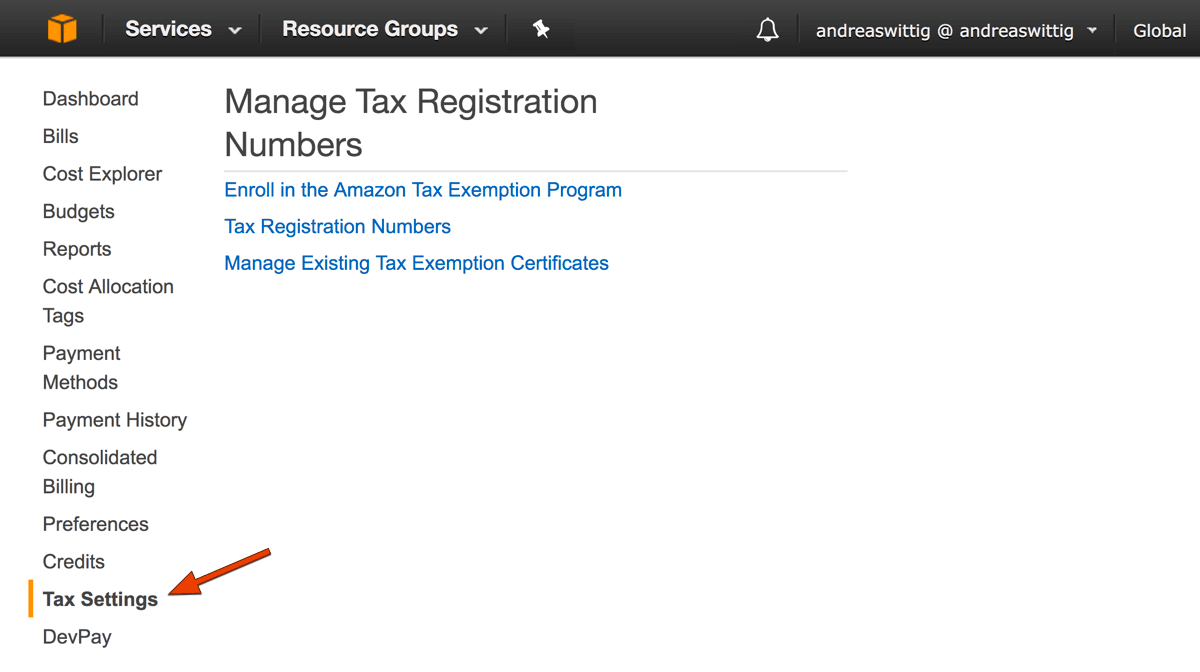

- Go to the Tax Settings

- Click on Tax Registration Numbers

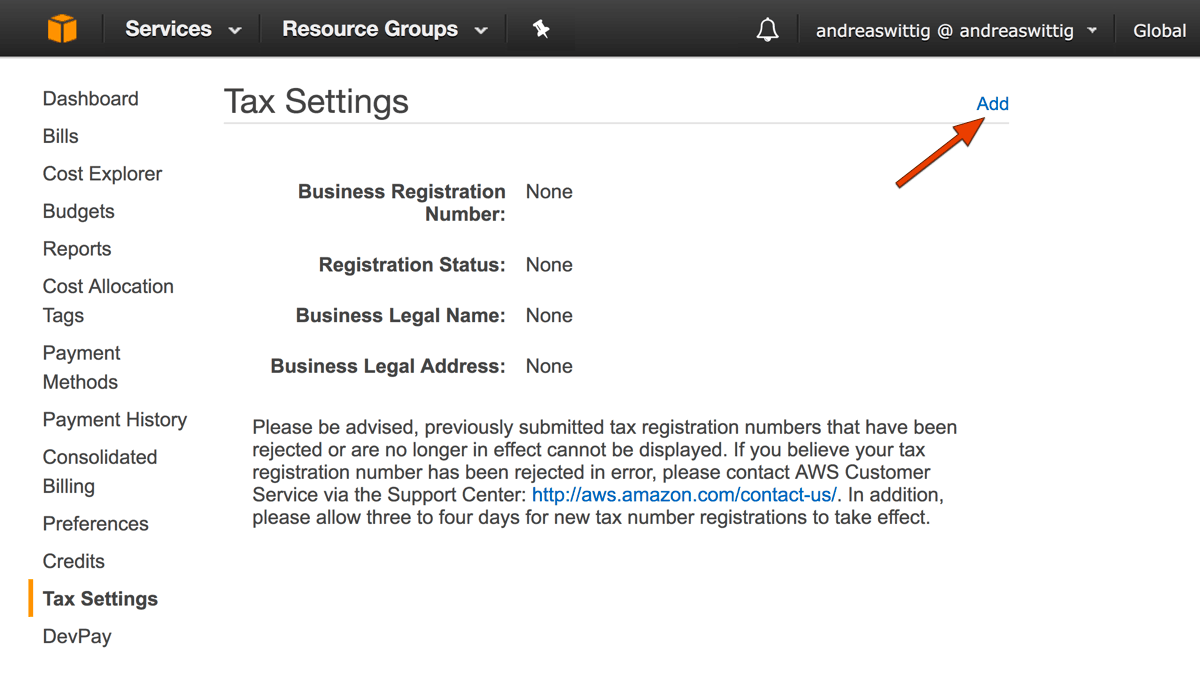

- Click the

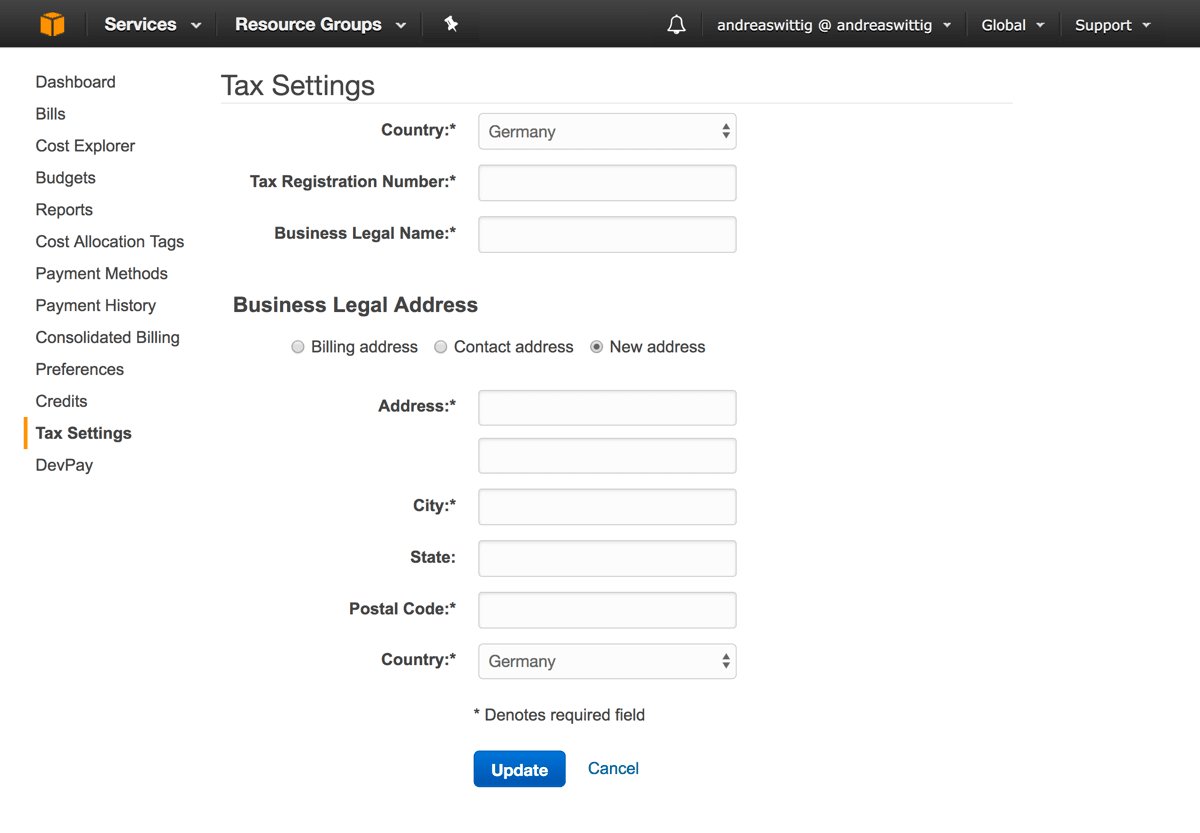

Addlink. - Enter the VAT registration number and the details of the business.

- Press the

Updatebutton. - Wait a few days until AWS verified your VAT registration number.

Opening Tax Settings

Adding VAT registration number

Typing in VAT registration number and business details

A similar option may exist for your business based outside the European Union as well. Check the AWS Tax Help for details.

Thanks to Thorsten Höger for reviewing this article.